The Shifting State of Streaming, TV, and Video Entertainment in 2025

The past five years have shown that the video entertainment industry is as volatile as they come, and this year has been no different.

11.20.2025

In 2025 we have seen a notable rise in consumer spending on video entertainment, yet SVOD services saw higher churn rates. American and Canadian audiences are spending significantly more time watching video content, but that time is being split between more video sources than in 2024. Cable cord cutting is up, yet this year more people are resubscribing after cutting it.

Those are just a few of the ways a once relatively straightforward industry, anchored by cable bundles and a few big streaming players, has become a far more dynamic, multi-platform ecosystem where viewers move fluidly between subscription services, free ad-supported channels, and traditional TV.

A Fragmented but Growing Market

North American audiences are consuming more video content than ever before. The average viewer now spends over five hours a day watching video content, up from 4.4 hours just a year ago. But that time is being divided across an expanding range of options. In 2025, viewers report using nearly 11 different video sources, compared to nine in 2024.

This fragmentation hasn’t dampened spending; it’s fueling it. Consumer spending on video entertainment has risen by $20–30 per month on average year-over-year; driven largely by the popularity of bundled offerings and seasonal price hikes. While this may signal sustained demand, it also underscores how competitive the attention economy has become. The modern viewer isn’t loyal to platforms; they’re loyal to experiences that feel personal, original, and exclusive.

SVOD: The Churn Challenge

Subscription-based streaming (SVOD) remains a backbone of digital entertainment, but the road ahead is looking increasingly bumpy. SVOD churn rate has climbed sharply. Over one in four consumers have canceled a streaming service in the past six months, while nearly 29% have added a new one in that same period. This is compared to 18.5% and 19.2% respectively last year.

Interestingly, SVOD viewing habits are also evolving. Primetime still dominates, accounting for about 41.5% of viewing, but has dropped from 48.6% in Q2 2024, while morning viewing jumped to 15.5%, up from 11% last year. What were once seen as evening binge platforms, SVOD is now creeping into North American day-time habits.

This increase in morning watch time is not necessarily a bad signal for dramas, thrillers, or traditional evening programs. It is, however, an opportunity for new program types that once struggled on SVOD platforms. Combine that with the increased volatility and we could see an SVOD platform take significant daytime, lunch-break market share that was once reserved for shows like The Price is Right or Family Feud on cable.

FAST: Free, Familiar, and Flourishing

If SVOD represents subscription volatility, Free-Ad-Supported TV (FAST) represents stability through accessibility. Viewership is up 8% year-over-year, with audiences gravitating toward both genre-specific and nostalgia-driven channels – everything from 24/7 sitcom marathons to curated news and lifestyle feeds.

The average viewer reports that they now watch nine different FAST channels, nearly double last year’s figure. That expansion highlights how FAST has evolved from a “background” option into a core part of the entertainment diet.

While the continued growth of FAST services may be another sign of the impending death of cable, cord cutting numbers may be telling us a different story. As expected, the number of people planning to cut cable has grown, up 3% since last year. However, a report from Tubi showed a 10% increase in respondents who resubscribed to cable after cutting it. In an environment that is bringing more choices to consumers with each passing day, legacy services seem to be holding strong with a corner of the market.

Navigating What’s Next

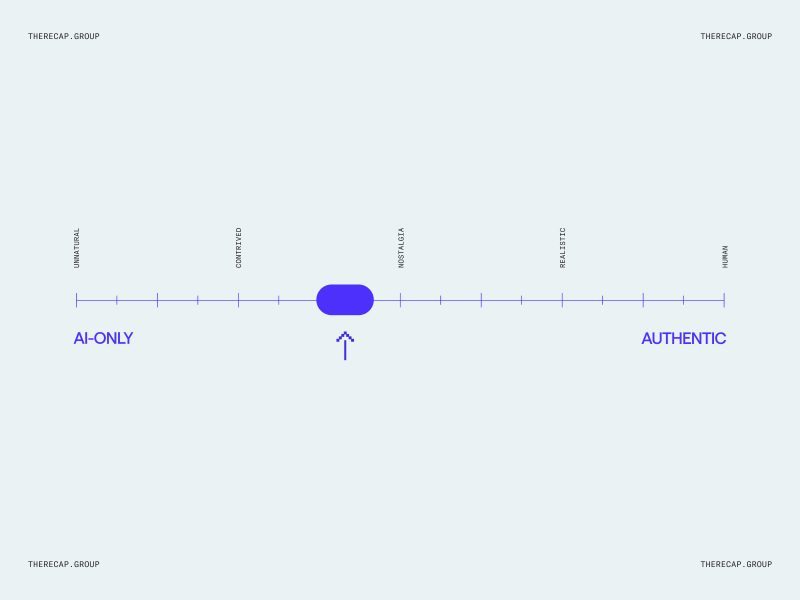

Amid rising costs, growing choice, and fluid viewer loyalties, it is clear that the modern video ecosystem thrives on movement. Audiences are experimenting, mixing formats, and redefining what “TV” even means. For media leaders, the opportunity lies in embracing that fluidity – developing content strategies that bridge paid and free models, leveraging data-driven personalization, and recognizing that yesterday’s opportunities will certainly differ from tomorrow’s.

Sources:

blog.tivo.com